[2023 Version] Salary Information

Main contents:

A. Salary information (details)

B. Labour contract (details)

C. Dependents information (details)

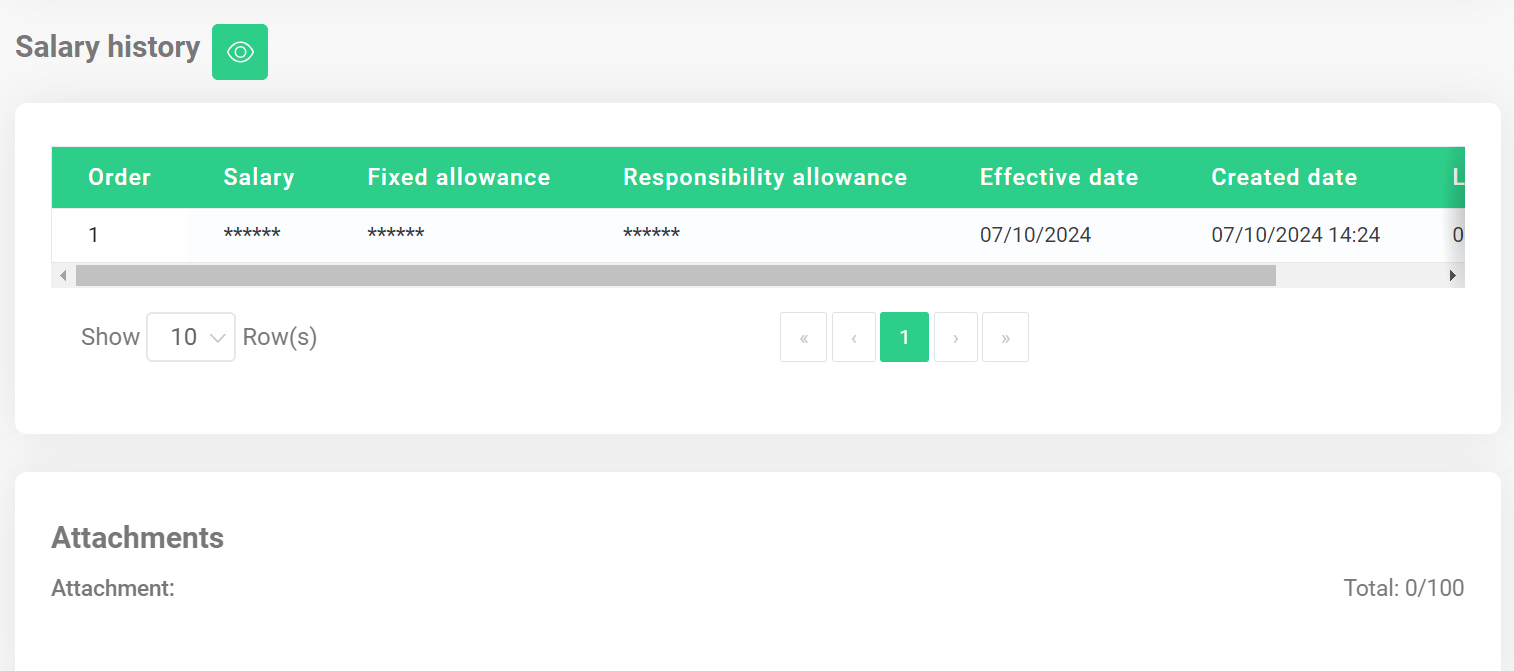

D. Salary history and Attachments (details)

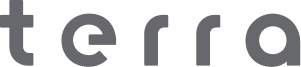

A. Salary information

To check the salary information, follow these steps:

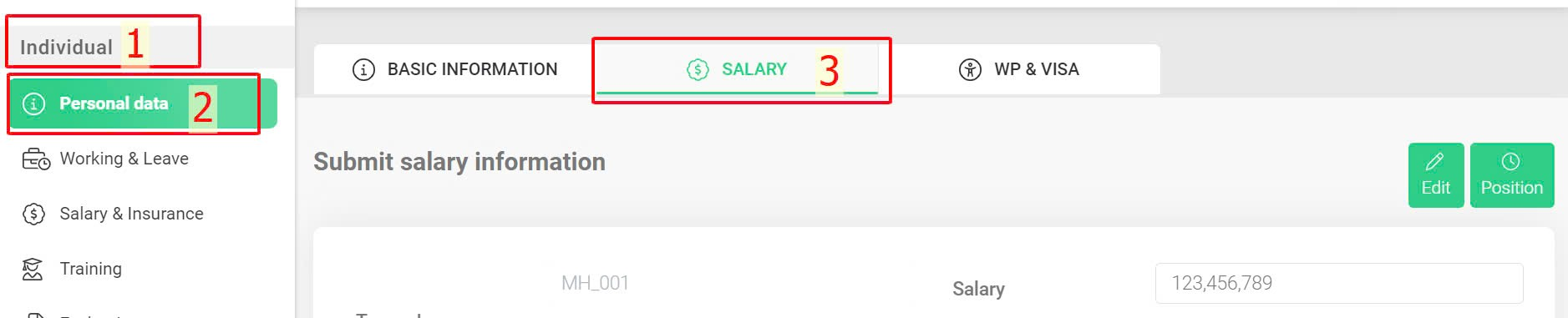

Steps: Individual > Personal data > Salary

To view the details of the hidden data fields, click on the icon

The data in this section is primarily used for salary calculation and to display the allowances that employees are entitled to.

Note:

-

Employees can view only the salary and insurance information. Only management accounts can modify this section.

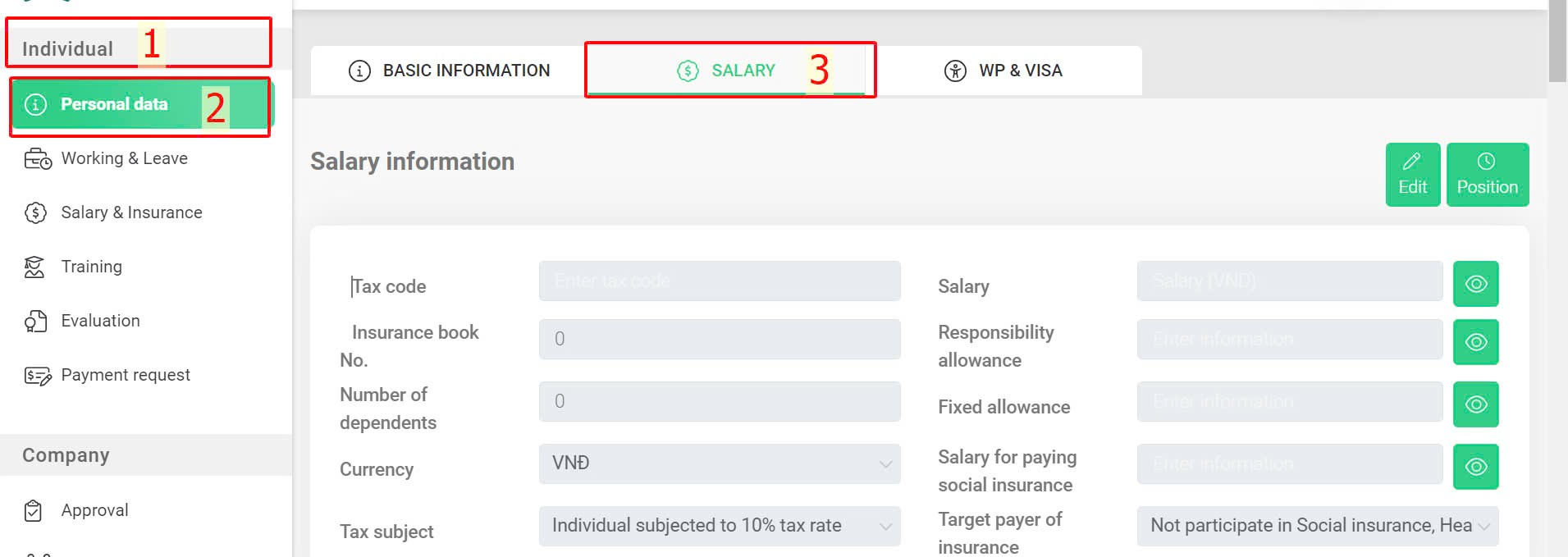

B. Labour contract

Employees can view the details of their labour contract with the company, click on the icon  to download.

to download.

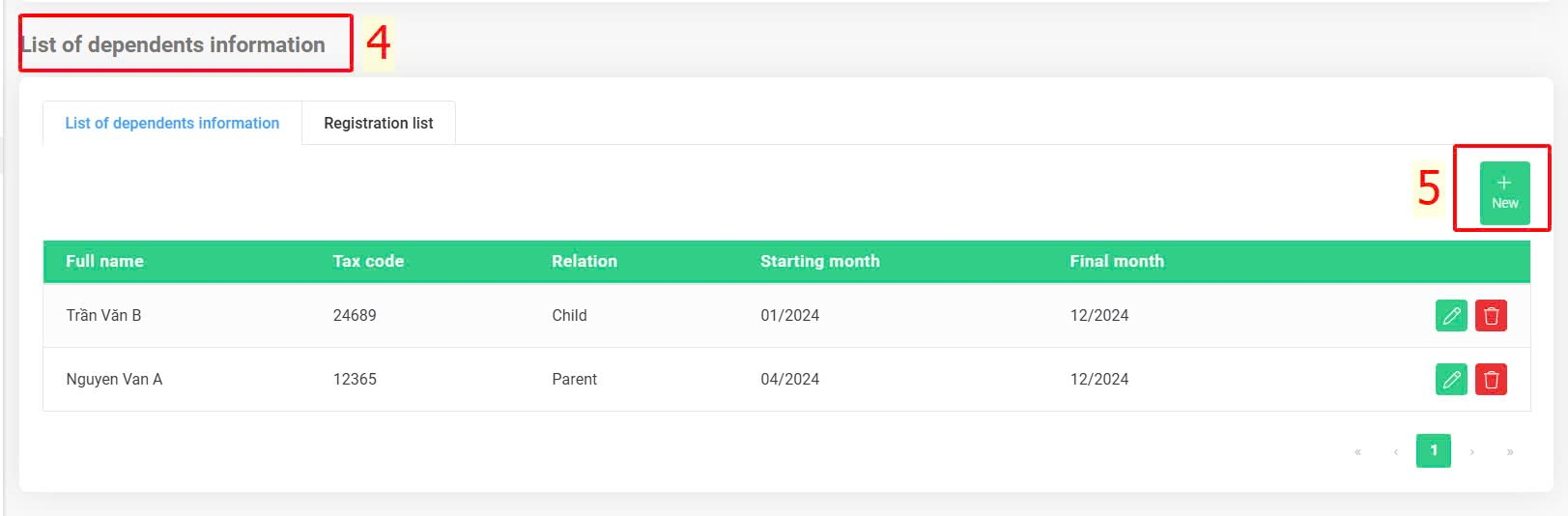

C. Dependents information

Employees can view their dependents' information on this screen. Additionally, suppose employees want to declare additional dependents to provide data for the HR department's salary calculation. In that case, they can register dependents information and send it to their manager for approval by following these steps:

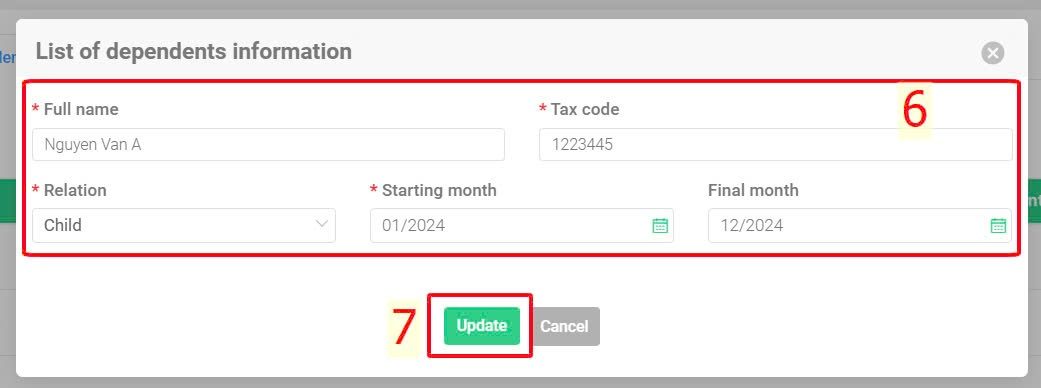

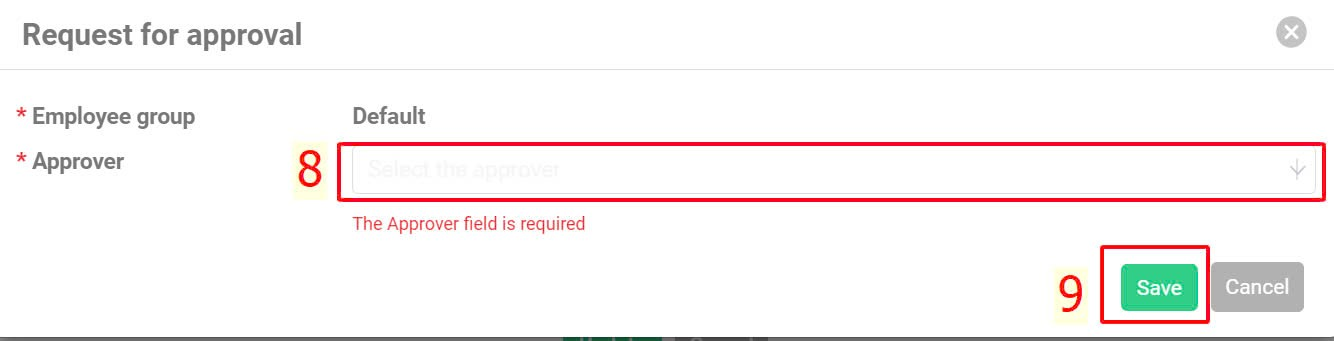

Steps: Individual > Personal data > Salary > Dependents information > New > Input information > Update > Select the approver > Save

Annotation:

Glossary |

Explanation |

Full name |

Dependent's full name |

Tax code |

The dependent's tax code has been registered with the Tax Authority and can be queried online. |

Final month |

Can be left blank in case the dependent's deduction period end date is unknown. |